Argus Insights Metrics show demand for Apple Products slowing just in time for the holiday season

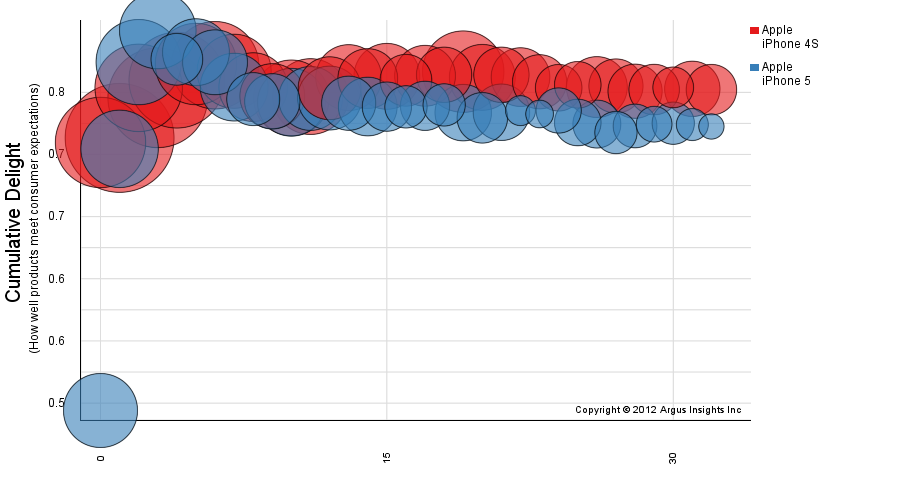

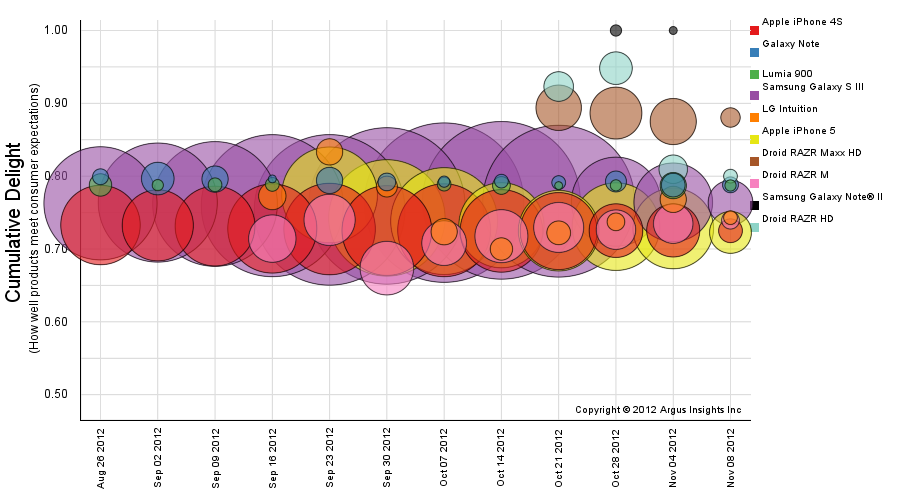

Bloomberg and others have widely reported on Apple’s recent 20% fall off their intraday peak of over $700 per share. What’s behind the market slowly falling out of love with our favorite fruit company? Apple’s recent product launches have not provided the boost in social capital needed to arrest the slide Argus Insights posted on recently. In fact, the iPhone 5 launched below the starting point of the iPhone 4s (remember how disappointed you were it in Oct 2011 it was not the real iPhone 5?) and continues to erode delight in the eyes of consumers.

Each new product launch is supposed to pour new social capital into the brand equity of a company by finding new ways to surprise and delight consumers. Not only did the iPhone 5 fail to breath new social capital into Apple, it failed to beat other recent mobile launches for the top spot in the smartphone market. Yes, sales are robust but remember that our metrics of social capital are proven leading indicators of sales volume. Based on our analytics, without a major injection of Social Capital, Apple will continue to lose mindshare and marketshare to other OEM’s.

The same is happening in the Tablet market. The long rumor and even longer anticipated iPad Mini is off to a slow start in the hearts and minds of consumers. While many consumers find it to be all that Apple promised it is still overall not offering the “condensed” magic Ive promises in the launch video.

In fact, as you can see the iPad Mini launched clustered in the same pack as the Nexus 7, Nook Table, and Kindle Fire HD. The iPad Mini’s social capital is increasing but still puts it below big brother iPad and the recently launched Win 8 RT Tablets.

Does this mean that Apple is losing it’s edge? No. It is hard to lead the market all of the time. MicroGoogSung is giving Apple a run for their money, spending more on design and user experience. If you contrast the launch events for the Microsoft Surface and the iPad Mini, Apple showed off more specifications and technology while Microsoft demonstrated user scenarios, what a shift! Apple has the war chest to reinvest in the user experience and drive their social capital back up. Their recent investments did little to drive new social revenue in the hearts of consumers and the street is punishing them for this.

Mark J

November 9, 2012 @ 12:20 pm

John,

Very interesting analysis. If you are interested in discussing a collaboration I have a very granular innovation strategy research methodology that seems to be aligned with your approach and may complement it by building out deeper levels multi-dimensionally. My data charts and sizes specific Beachheads and discontinuous growth opportunities (e.g. Outliers and Overhangs) very quantitatively, and it is built in Tableau – which from your visualizations I think you are using too. Currently it is focused on medical product markets. I too came out of Stanford’s Design programs (MSE from a joint program with the ME Design Division). Email me if you would like to discuss this further. Mark J.

iPad yields to Android Overlords? Wait till Back to School | Argus Insights Blog

July 30, 2013 @ 1:18 pm

[…] Android sales have been much higher than iPad sales. We’ve seen the iPad stumbling since the launch of the Gen 4 iPad and the iPad mini in the fall. The closing experience gap between Android and iOS tablets has led to eroding demand […]