Passively Satisfied Aren’t Passive Nor Satisfied…

I recently attended a fantastic CMO conference in San Francisco where I was able to observe the mostly graceful dance between vendors and the CMO’s themselves as the group wove together conversations of the emerging needs and solutions with Marketing today. In the midst of the continuous banter of “the CMO is the new CIO” and the fact that “your Facebook fan page is not an owned asset” was the constant presence of Net Promoter Score (NPS). Many CMO’s in the room were stalwart fans, others just starting, but a vocal minority advised caution, citing dark tales of where NPS let them astray.

Recently Bruce Temkin released analysis of actual NPS respondents across multiple sectors and found that the rigid categories of promoter, detractor, and passively satisfied while generally were interesting, in many aspects that matter did not accurately represent consumer behavior. For example, in their broad industry NPS survey, his team found, on a scale from 0 to 10, actual humans tended to clump their responses in three choices, 0, 5 and 10. Under the NPS guidelines, that would put the bulk of the population in two buckets, detractors and promotors, with a bias towards detractors. Knowing this about human behavior writ large kind of messes with the math of Net Promoter, which in turn, mucks up the metrics many companies are driving their business with.

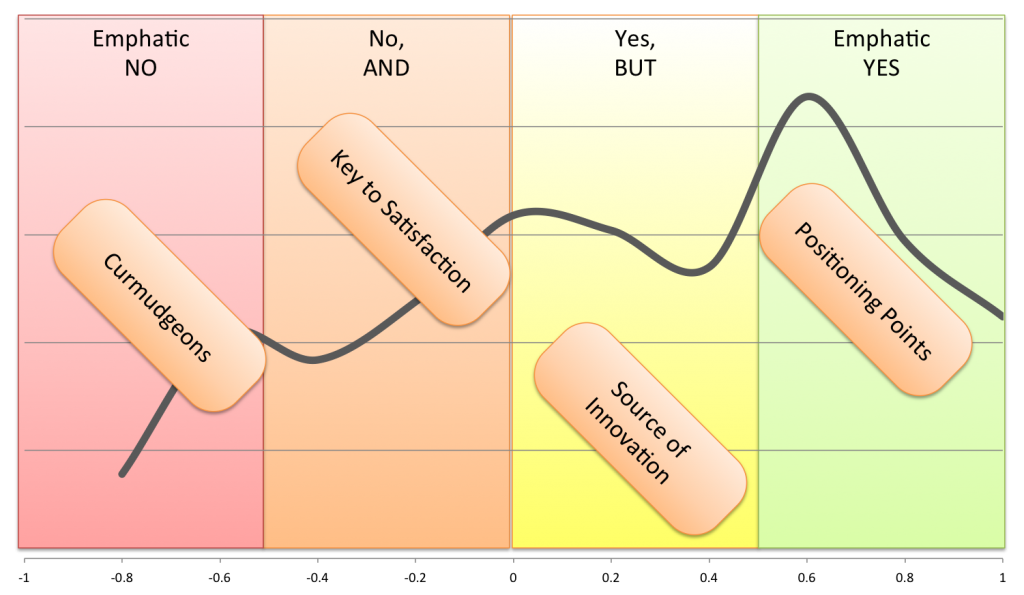

Don’t get me wrong, I love the notion of the Ultimate Question and the insights that can be pulled from it. I just take issue with the over-simplified math of NPS BECAUSE of how people answer the question. Our own research at Argus Insights, where we pay attention to both the numbers and the stories provided by consumers, provides a few startling insights. While we use multiple sources for our analysis, consumer reviews are particularly interesting because it allows us to see how consumers respond to other multiple products/services. Does a particular consumer love everything or hate everything, such as if they hate the Samsung Galaxy SIV do they also hate Zumba DVD? By understanding the patterns of consumer behavior coupled with an analysis of their own unsolicited opinions, we found that the NPS methods focus companies on the wrong consumers. By dictating that the Passively Satisfied data be thrown own and that firms could be laser focused on turning Detractors to Promoters, companies are leaving opportunities for Innovation on the table. Based on our research, we divided the rating scale into four categories, each with a different impact on the strategic moves the company can take to improve their relationship consumers.

What NPS would call Promoters we call the “Emphatic Yes”. These people love your product and will crow about it the the whole world, NPS is right, they are promoters. They are also the source of what position points should be used in messaging because we know, at least for these delighted consumers, what they are happy with and it may be different than what you thought.

Skipping to what NPS call Detractors we found two styles of behavior. First, the most negative consumers tended to be negative across reviews. Simply put, they are “Curmudgeons”. It would be a waste of resources to try to make these consumers happy, yet NPS says companies should focus their energy on turning them into Promoters. Where the real opportunity lies is within the “No And” group, short for “NO, I don’t like this experience AND these things are not bad.” This is the population companies have the best shot at turning into promoters. By understanding what drives the NO and doing more of the AND, firms can harvest low lying fruit to improve satisfaction.

Where the crimes of NPS passion are most egregious are in the Passively Satisfied. Ignored and shunned by NPS practitioners, Argus Insights finds these consumers to be the rich veins of gold to be mined from your research. These “Yes, But” consumers are your lead users as defined by MIT Professor Eric Von Hippel (you can actually download all his books for free), consumers that like what you have to offer but see some opportunities for improvement. Our research showed that these consumers are living life a bit in the future of the rest of the market so not only do they continue to support your product/services but are providing free insights as to what would delight them more in the next release. NPS demands you leave these opportunities for innovation on the cutting room floor when you discard the Passively Satisfied, which means you are unlikely to uncover the innovations that could lead you from the dark tunnel.

If you would like to learn more about the insights we are able to extract from the less than Passively behaving not quite Satisfied consumers, check out our Social Intelligence Platform.