What did Lenovo Just Buy? Moto A Bargain at 1/4 the Price?

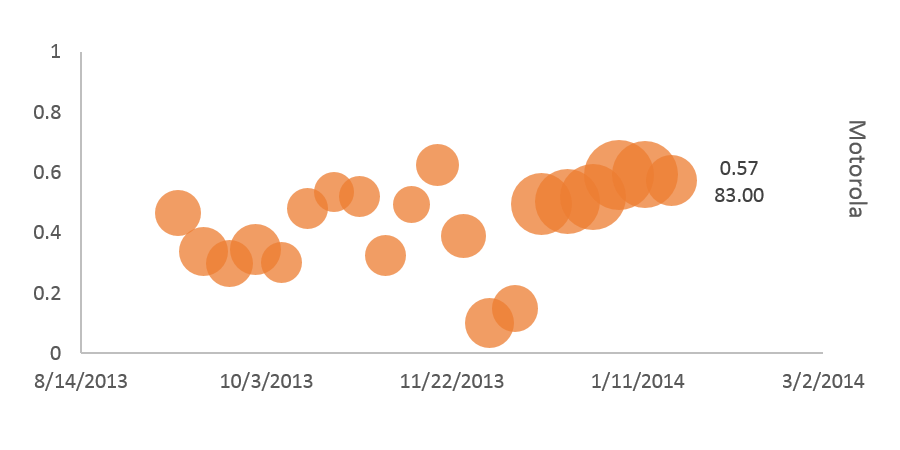

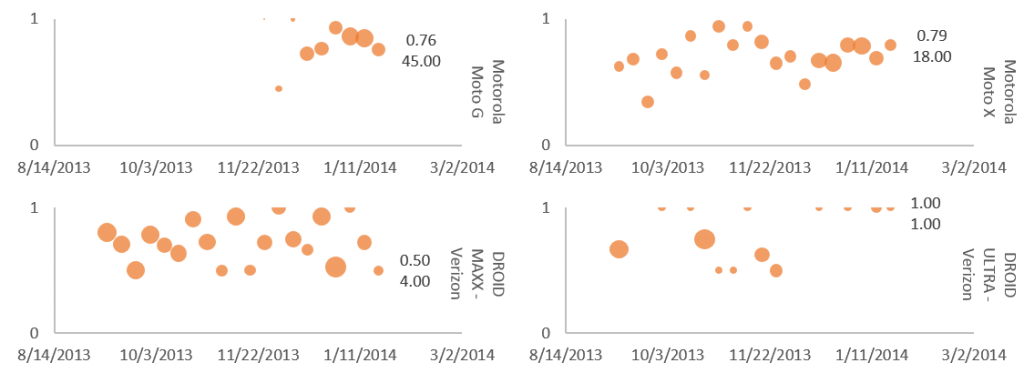

Motorola is now Lenovo’s latest addition to their growing collection of faltering US hardware businesses (props to Cam Dales for this observation). Google keeps most of the IP from the $12Bil acquisition they did in 2012. Lenovo adopts a handset brand with a rich history, poor present and uncertain future. After wild success in the 2000’s with their ultra cool, ultra thin handsets, Motorola failed to shift from a hardware focus to an experience focus after the iPhone was launched and has struggled ever since. After the Google acquisition, many hoped this would bring the strengths of the two companies together to finally have a company with the resources, both intellectual and financial, to compete with the iPhone walled garden of near infinite acreage. The early shared efforts produced as many fruitful results as a presidential debate: lots of noise, both hardware and software claiming victory but little real progress. The recently released Moto X and easier on the wallet Moto G were supposed to be the first real offspring of this union of the great and formerly great. As you can see below, these products have lifted perceptions of Motorola handsets in recent weeks but the brand still trails the competition, currently ranking only ahead of Nokia and HTC in terms of delighted users.

In fact, if it wasn’t for the Moto X and Moto G, Motorola would be on par with upstart OEM’s from Asia vying for a foothold in the US market such as ZTE, Kyocera or Huawei. The Verizon branded DROID line bare attracts enough engaged consumers to even review the products.

So what is Lenovo buying? A supply chain that terminates in Texas? Two thousand patents that Google did not see a need for in the future? Carrier relationships in the US market? Engineering talent that did not leave before the last acquisition? To be fair, Motorola still turns out quality hardware as evidenced by the recent infusion of delighted Moto X and Moto G customers. Unfortunately it takes more than just solid hardware engineering to compete in the mobile market. The mass customization experiment of choosing between any one of 45 billion is paying dividends and makes Apple’s laser engraving seem like carving your initials with a butter knife in comparison.

Will Lenovo have the patience to let the current Moto brand story play itself out with consumers? Will this acquisition stall Lenovo’s own entry into the US market with their successful handsets? Right now we see the direct appeal to consumers that Motorola has been pushing with the X and G is slowing paying a return. Our hope is that it continues to grow and that this latest marriage for Moto will become the happy ending we all wished for this veritable brand.