Which Smartphone OEM’s Will Gain on Apple and Samsung Next Quarter?

Already we’ve heard from Apple and Samsung that their future is not as rosy for Smartphones as investors had hoped. In reality it is like expecting early automobile dealers to continue to grow sales after they have replaced all the buggy carts in the neighbor hood. The saturation is smartphones will make it difficult to continue their past growth and open up threats to their dominance as the smartphone consumer fragments into niche segments clustered around unique specializations such as gaming or photography.

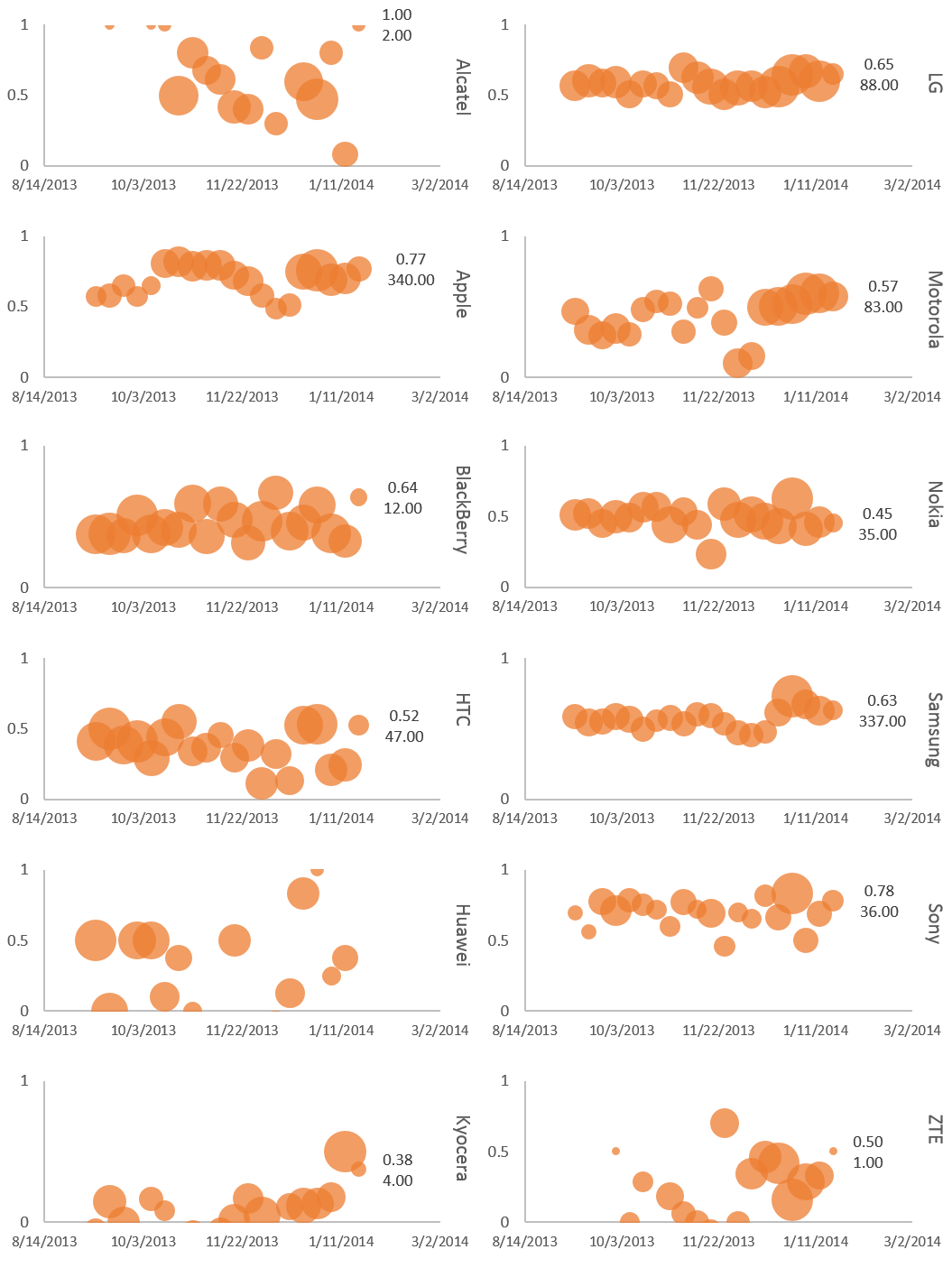

Below is the latest snapshot from Mobile Handset Consumer Demand in the US, Canada and the UK. Not only did Apple Buzz levels exceed Samsung for the first time in weeks, Samsung’s Consumer Delight Score also fell this past week. Sony and LG delighted customers more than Samsung, Sony even exceeded Apple as consumers look for differentiated experiences. Nokia has fallen off since the holidays, showing slack demand. While Motorola’s buzz levels have increased at the same time consumers are excited about cheaper Moto X and Moto G handsets, the rest of their portfolio continues to drag the brand down. Sony and LG have the most to gain by the “stumbling” of Apple and Samsung while Nokia and Motorola have best base rebuild while BlackBerry continues to fade from the hearts, minds and wallets of consumers.