AT&T Misses Estimates, Cuts Forecast, Adds More Fuel to Fire Phone

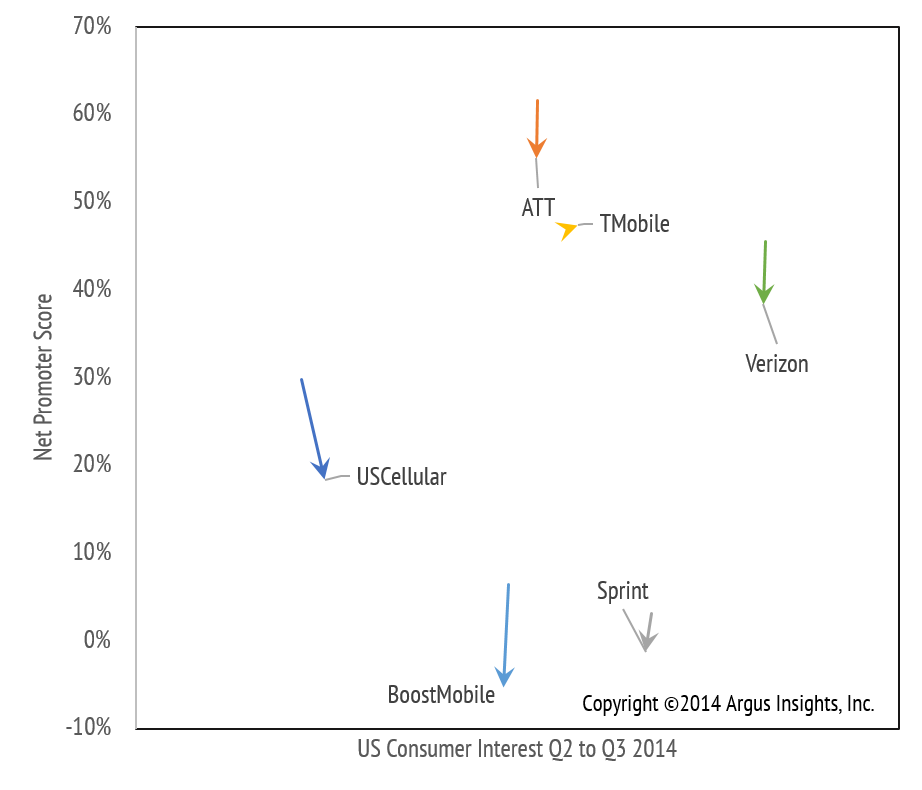

Scott Moritz’s coverage of AT&T’s recent miss of Wall Street expectations is just another bit of evidence that launching a new handset on AT&T’s network has not worked out well for AT&T or the handset manufacturer. The graph below demonstrates that AT&T is not alone in this descent, as every Smartphone retailer except T Mobile saw a drop in consumer delight from Q2 to Q3. As retailers are fighting to maintain subscribers, it appears they are sacrificing service as their new and current consumers are reportedly less satisfied.

After Amazon’s Fire Phone underperformed earlier this year with AT&T as its exclusive retailer, the bad news keeps coming. While AT&T is still the most loved retailer on this chart, they saw a drastic drop in NPS. AT&T saw a growth of “785,000 monthly subscribers,” but they are losing revenue as “7 percent of customers…brought their own devices instead of buying one.” This, along with other factors, reportedly drove the average AT&T customer bill (excluding installment payments) down 8%. The Quarter brought less money for AT&T, less new handset sales for manufactures, and less delight for consumers.

Consumer delight is dropping across retailers in the Smartphone market as retailers are participating in a “pricing battle” to “protect their subscriber base.” Argus Insights will continue to track this battle in the smartphone market and keep you updated. For more information about any retailer, brand, or product across any of the sectors we cover, please contact Argus Insights. If you interested in free weekly insights about Smartphones, Wearables, or Home Automation, sign up for our Weekly Newsletter.