Smart Home Service Providers Slide After Tremendous Holiday Season: Q1 2017 Results

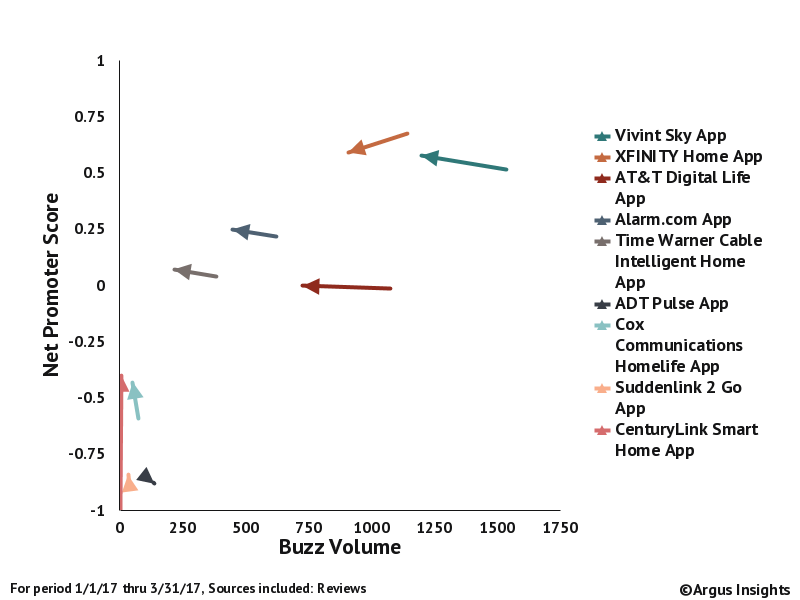

While much of the Smart Home market is focused on Do It Yourself, there has also been robust demand within the Do It For Me part of the market supported by Smart Home Service providers like Vivint or Comcast Xfinity Home. While overall consumer interest declined in Q1 2017 over Q4 2016, March 2017 saw a significant increase over February 2017, indicating that a combination of spring promotions and increased interest in Do It For Me based on holiday DIY experiments.

Vivint clearly wins out for the overall consumer demand during Q1. Most service provider customers write reviews soon after they sign up or after a new version of the App has been released. We can see from the graph above that Vivint leads the overall tally of quarterly mindshare but lags a bit behind Comcast with respect to Net Promoter Score. AT&T is still in the mix but has more frustrated consumers than Comcast or Vivint. In March, Vivint saw improvements in their UX while Comcast dropped over the quarter so they they are within 1% of NPS from each other.

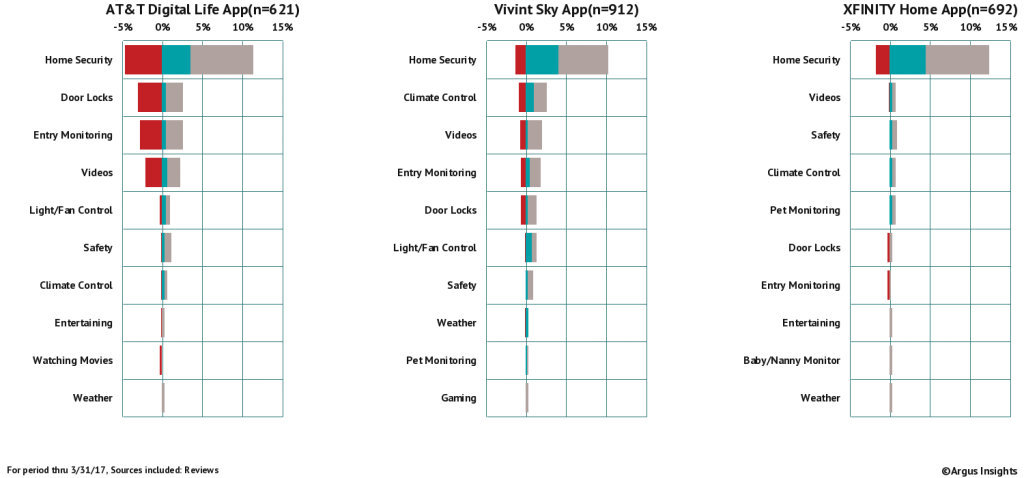

When we dig deeper into how consumers report using their Smart Home with their lives, it should come as no surprise that Home Security is the most discussed usage scenario. Securing your home is still the main reason consumers sign up for Do It For Me services though you can see this shifting for Vivint as they list Climate Control more than any other service provider. AT&T customers are clearly grump about their security and entry control experience with Digital Life. Comcast customers are focused on Security almost to the exclusion of other scenarios though Xfinity customers mention monitoring their pets more than AT&T or Vivint customers.

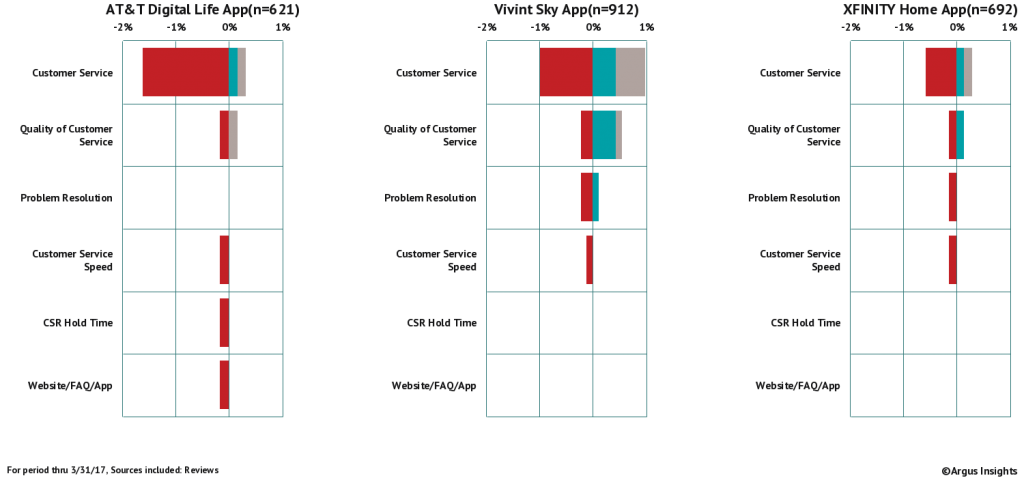

Customers of Do It For Me tend to value Customer Service in their selection of service providers. While consumers do not mention their experience with Customer Service as much as other topics, you can see a definite correlation between the service provider’s Net Promoter Score and the consumer perception of their customer service experience. AT&T has the most negative mentions of the top three service providers. Vivint has more negative comments than Xfinity but also more positive. Vivint is also the only provider with a net positive perception of the Quality of Customer Service, a surprising outcome to be sure.

Of course we have more data behind just this basic analysis. Quotes from consumers on specific issues, comments on the installation process and more, with data going back literally years to assess the impact of changes and new innovations being unleashed on the Smart Home market. You can get access to these tools yourself, using the Argus Analyzer. Learn more by clicking below.

Schlage Locks Up Smart Entry Market for Q1 2017

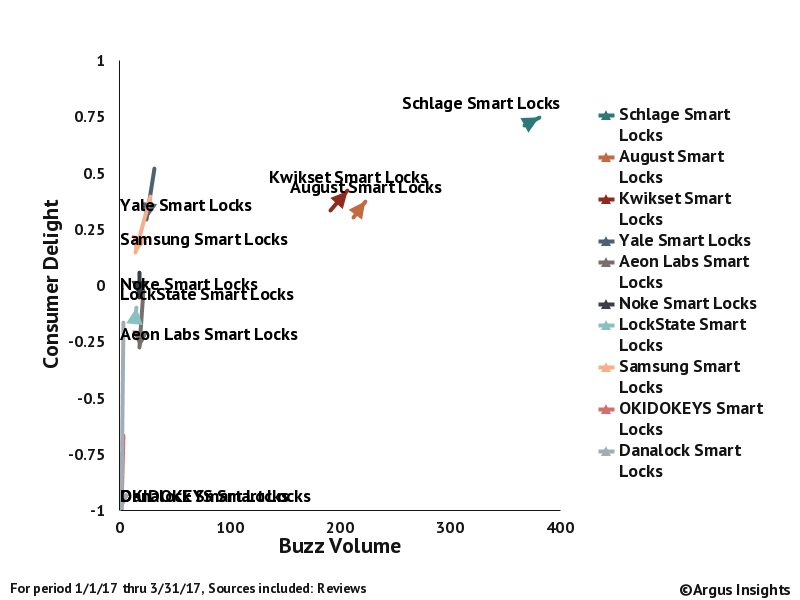

Smart Lock interest grew in 2017 as consumers holiday purchases turned into Saturday morning honey-dos. The big winners in Q1 were Schlage, August and Kwikset. The rest of the competitive landscape is littered with products that have been disappointing consumers persistently.

Schlage is leaps and bounds ahead of their competition, not only seeing increases in both buzz and perceived UX, but also almost double the demand of their closest competitor. Wow. What is Schlage doing to consistently beat out their traditional competition like Kwikset and Yale as well as the newcomers like August and Aeon Labs?

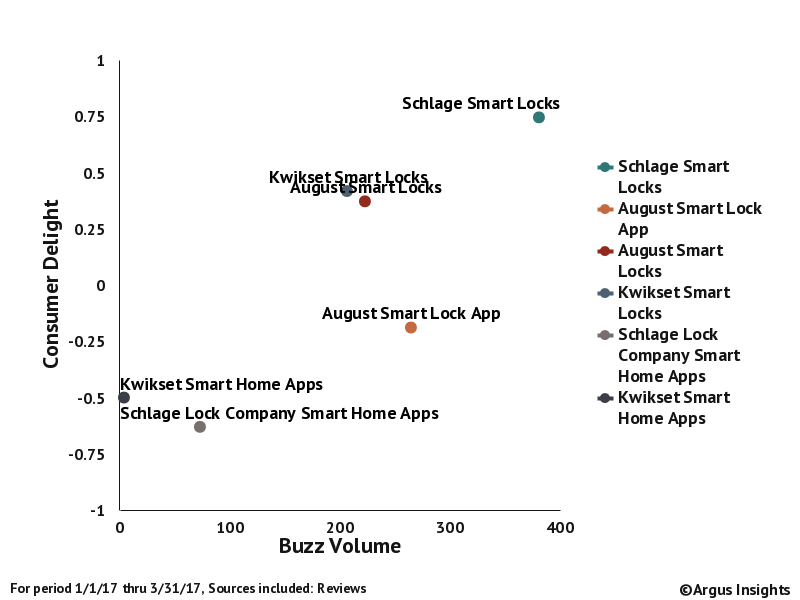

Well, it’s not their app. Schlage is lacking on the App side of the Smart Lock experience. August does a better job of delighting consumers with their app interface and their integration with Comcast Xfinity Home. Schlage and Kwikset, traditional hardware (yes, they actually cut and cast metal to make their products) companies have been lacking in their app ecosystem for Smart Lock customers.

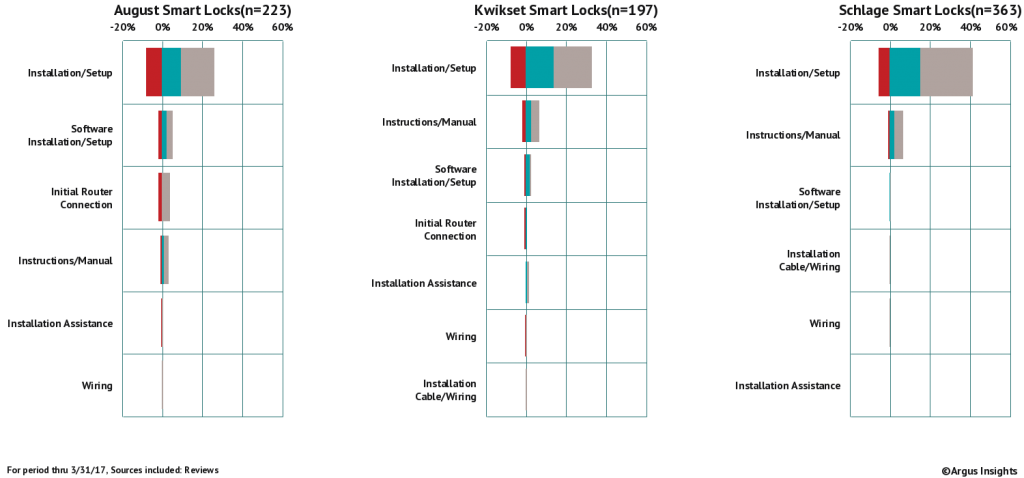

So why do consumers love Schlage locks but hate the apps? Why isn’t August dominating if their App is so much better? Turns out installation is important. When we dig into the details of how consumers talk about the installation experience a deeper story emerges…

Schlage is just simply easier to install. Schlage customers are frustrated (the red bar) half as much as their competition. They are almost twice as delighted by the installation experience as August. Simplicity sells, period. When we look at both August and Kwikset, we see frustrations with the initial router connection, software/app issues as well as issues around wiring and help from the company itself with installation. That means that both August and Kwikset could gain on Schlage by just improving their out of the box experience. That’s it!

Want more? Want to dig deeper to understand who is using these locks? What to see how August is performing across their products? You can get access to these tools yourself, using the Argus Analyzer. Learn more by clicking below.

Seeing Is Believing: Q1 2017 Consumer Perceptions of Smart Home Cameras

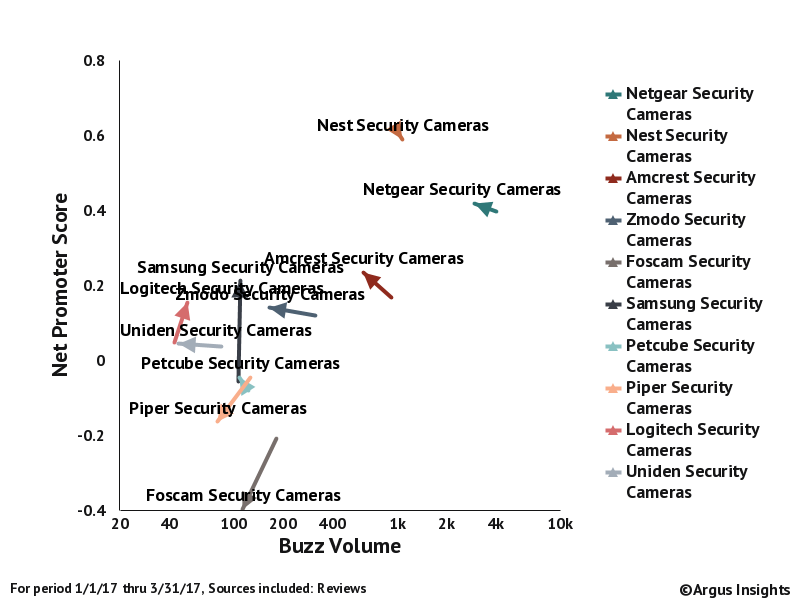

With the close of the first quarter of 2017, we can start culling through all of the consumer reactions to Smart Home devices they have purchased in the last three months. One market segment that is always of interest is Security Cameras. The Nest Cam and Arlo are flagship products in this category that still contains a dizzying array of brands and packages, ranging from ten camera bundles sold at Costco to individual cameras flying off the shelves at Best Buy and Walmart. The question is, post purchase, which brands are delighting consumers by delivering on the promised experience?

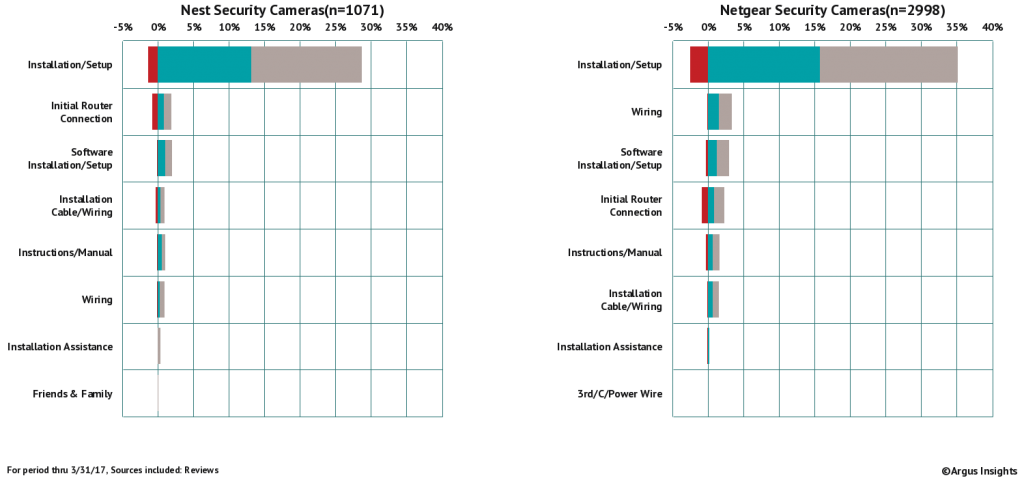

As you can see from the graph above, Nest and Netgear dominate the category. While we see demand for Nest Cam lower than the full portfolio of Netgear branded cameras, overall, Nest customers are happier with their user experience. You can see the cloud of other brands clustered in the area of lower demand and more frustrated users. Within this crowd, we see Logitech and Samsung making gains both in demand (Buzz is a proxy for demand) and Net Promoter Score. So what is the difference between Nest and Netgear for consumers? Some would argue that since Netgear makes most of the WiFi routers used to connect to these cameras, Netgear Cameras should be some of the easiest to set up, given that the initial connection to the WiFi router is a constant frustration for DIY consumers.

You can see from the Experience Funnels above (Red bars show what percentage of the reviews were negative, green indicates the percentage that were positive and grey is neutral) that Nest consumers mention the router set up more than software or any initial wiring. Overall the Nest Cam installation is a net positive experience. The same is true for Netgear. Since Netgear produces a range of cameras that compete both with the high end Nest Cam and lower end multi-camera bundles of Swann and others, you see Netgear consumers discussing Wiring and Software ahead of Initial Router Connection. While Netgear attracts more negative comments for their overall Installation experience, they receive a proportional increase in positive comments as well. In fact the Net Sentiment of Installation for Nest and Netgear is the same, about 13%, meaning that consumers for both brands found the overall experience of Installation to be positive, a key factor in driving Smart Home adoption.

Interestingly, Netgear’s prowess in WiFi did not translate into a significant differentiator for Smart Home Camera Installation compared to the other market leader, Nest. In a future post, we might dig deeper and do a direct comparison between Nest Cam and Netgear’s Arlo for a product level analysis.

If you can’t wait for the next post, check out our analytics platform, the Argus Analzyer, where you can dig deep into the bones of the user experience across the entire Smart Home market. You can also sign up for our free Smart Home market trend tracker, which includes basic access to the Analyzer and email updates whenever something causes the Smart Home market conversation in social media to jump.

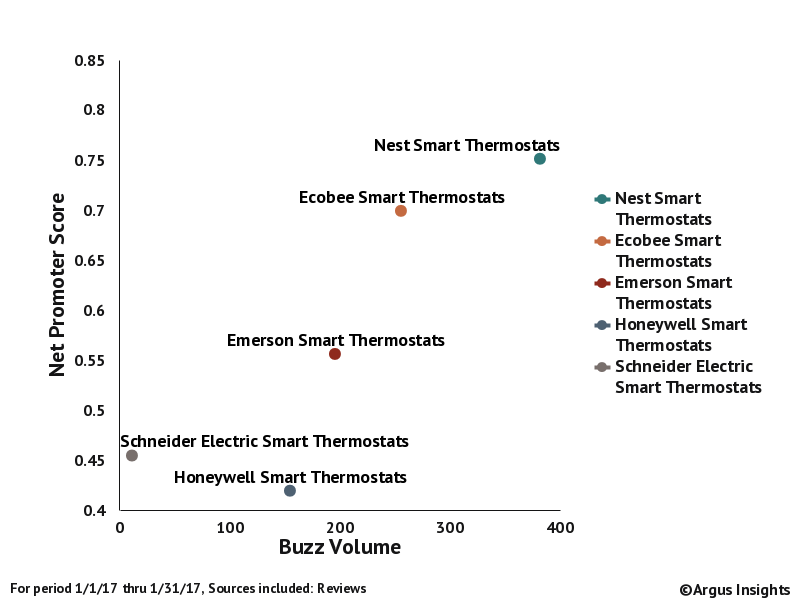

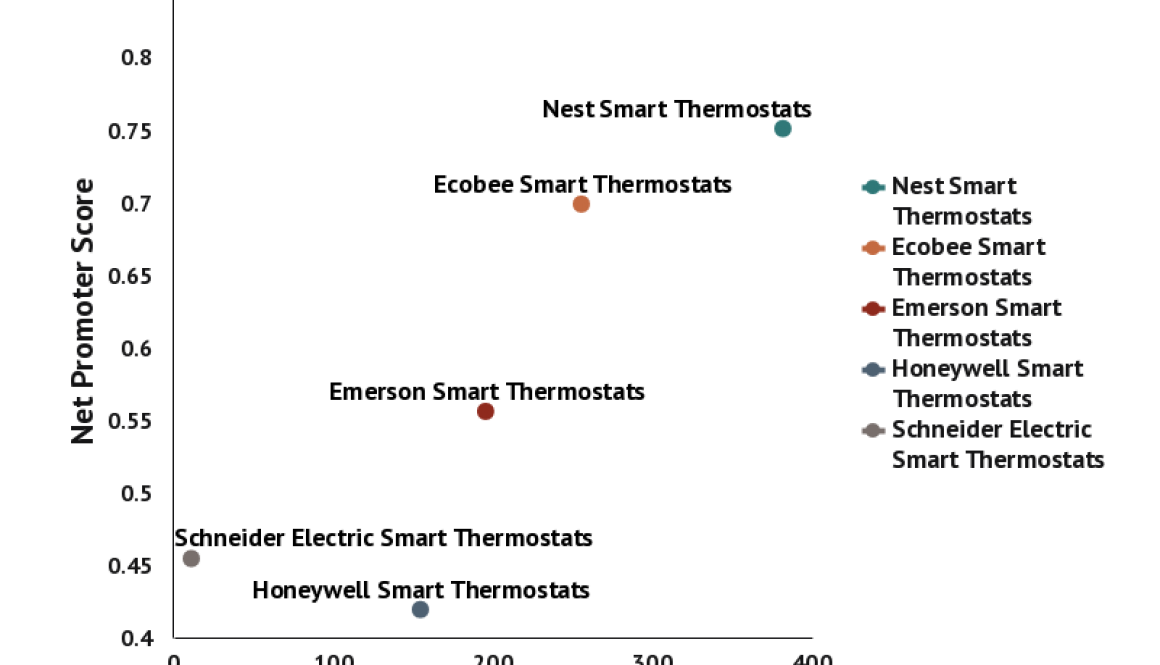

Top Smart Thermostat Brands Based on Consumer Perceptions

Out of over 1000 new reviews of Smart Thermostats authored by consumers in the month of January, we see that Nest is maintaining their leadership over the other brands within the market, both in terms of consumer demand and perception of the products as measured by Net Promoter score. The buzz level is down almost 50% from December when consumers, giddy with their holiday gifts, shared their views of their newly intelligent comfort control in greater numbers than we are seeing in January. Ecobee provides the biggest competitive threat to Nest in terms of both consumer perception of the overall experience and the consumer demand. Schneider Electric, though a smaller player, performs well against Honeywell from a Net Promoter score, indicating though the Wiser Air Thermostat may not have as large as an install base, those consumers that find their way into Schneider’s ecosystem are happier overall than Honeywell at this stage.

Consumers have a better chance of getting a product they won’t feel like ripping off the wall in a few weeks if they select any of these based, based on the verdict handed down by the court of public opinion. Our next post will explore some of the features of these products such as ease of installation.

Get your own access to the latest Smart Home consumer insights by subscribing to the Argus Analyzer platform. A Product Fit Insights plan includes all consumer reviews across the Smart Home ecosystem for the last quarter, including data like you see above. Check out how you can let the Argus Analyzer do the heavy lifting of collecting, analyzing and summarizing that is happening with you and the competition!

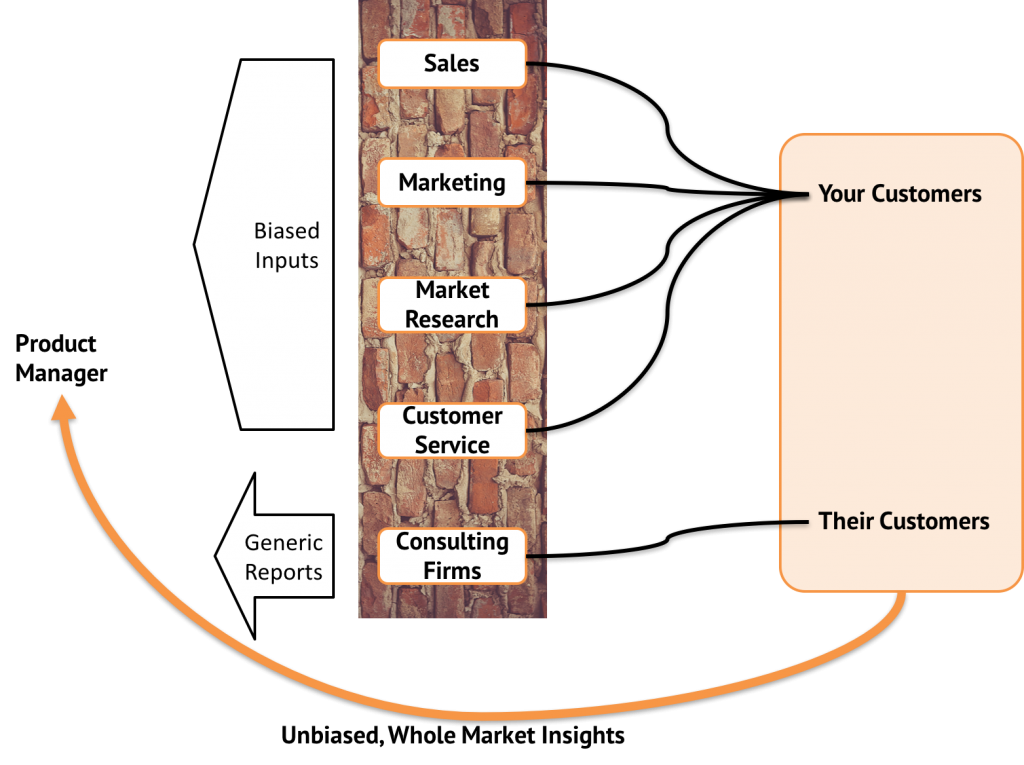

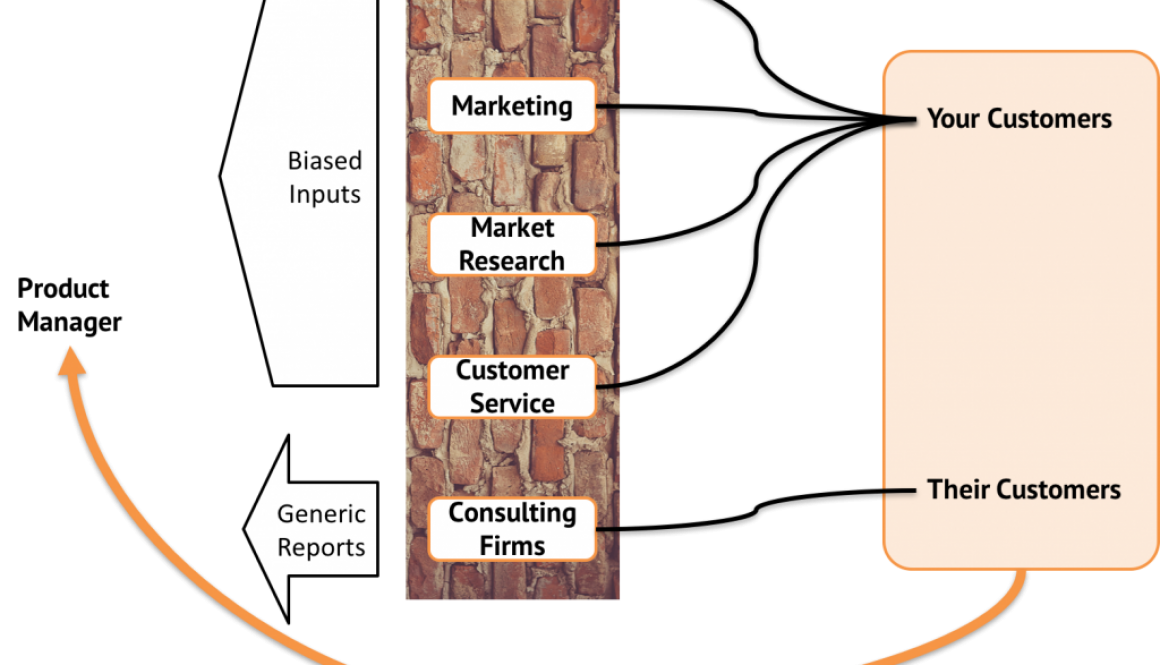

Product Managers Are Falling Victim to An Expert Game of Telephone

Remember the old party game, Telephone? The group sits in a circle and someone starts with a phrase and the fun is to see how much the phrase changes from it’s original version as it make its way around the circle. Great icebreaker but a terrible affliction for Product Managers. Think about, Product Managers are charged with the very soul of a company, the relationship between their product/service and the end customer. They are the fighter pilots of the enterprise, targeting markets, fending off competition, and last line of defense between corporate strategy and market reality. So why are there so many layers of obfuscation between the Product Managers and their target market? The diagram below introduces the Product Manager Web, a representation of the different sources of market intelligence that PM’s have to wade through on a regular basis to fight their way to actually having an impact on customers.

First off, the organic resources that have direct contact with your customers all bring their own agendas to the insights they share. It’s not a bad thing but PM’s need to understand the inherent bias these other stakeholders bring to their efforts to impact the market. Sales teams are famous for asking for additional features to be added based on their last client conversation, buoyed by the belief that, if they just had twice the speed at half the price, the sales team would meet their quota in the next 15 minutes. Outbound marketing and the agencies that support them are notorious for being unable to measure the half of their marketing that works, reporting on metrics like buzz and visits, always requesting more resources to boost these easy to capture but hard to use metrics. Internal market research teams with their surveys and focus groups are essential to get answers to specific questions but can often be used to reinforce outdated perceptions of the market. Ask anyone at Nokia after the iPhone was launched for war stories that will make you weep… Customer service organizations, inorganic (outsourced) as often as they are organic, excel at uncovering problems to fix. With a focus on reducing cost of engagement, there is little time or attention put to moving consumers from satisfied to delighted. All of these methods focus on current customers and prospects and find little to peek behind the curtain of the competitors and their customers. This gap is partially filled by consulting firms like Gartner and IHS iSupply which provide generic research that ensures everyone has the same data about everyone else, not necessarily a source of competitive advantage…

Product Managers hungry for direct contact with their market have few options, costly customer visits, endless hours trolling through reviews and twitter posts. Each of these methods drain resources of time and money from the PM’s efforts to defend their firms from the constant onslaught of competitors. We have been focused on this issue for a quite some time at Argus Insights and will be sharing much of what we have learned in future posts.