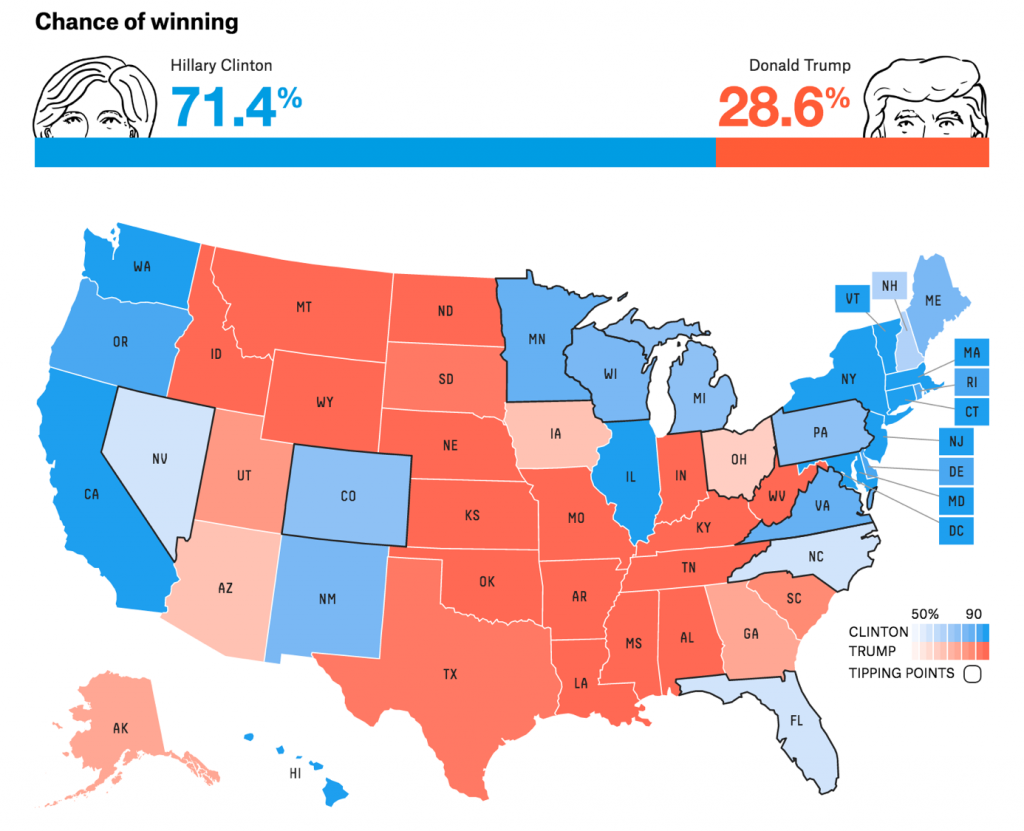

If you are currently trusting the future of your enterprise to market intelligence gained from polls and surveys, the results of this election should terrify you. Not for the outcome but for the failure of polls to deliver their promised certainty of the outcome. The 2016 election will go down as the day that polls failed us, or at least failed to represent what was actually happening in the population. FiveThirtyEight and the wunderkind Nate Silver, for literally years the most trusted analyst in politics because of his big data approach to predicting outcomes, published this prediction ahead of the polls opening Tuesday:

FiveThirtyEight.org’s Prediction of The 2016 Election Outcome as polls opened on Tuesday based on analysis of polls. Remember this is a likelihood measurement, not a guaranteed prediction.

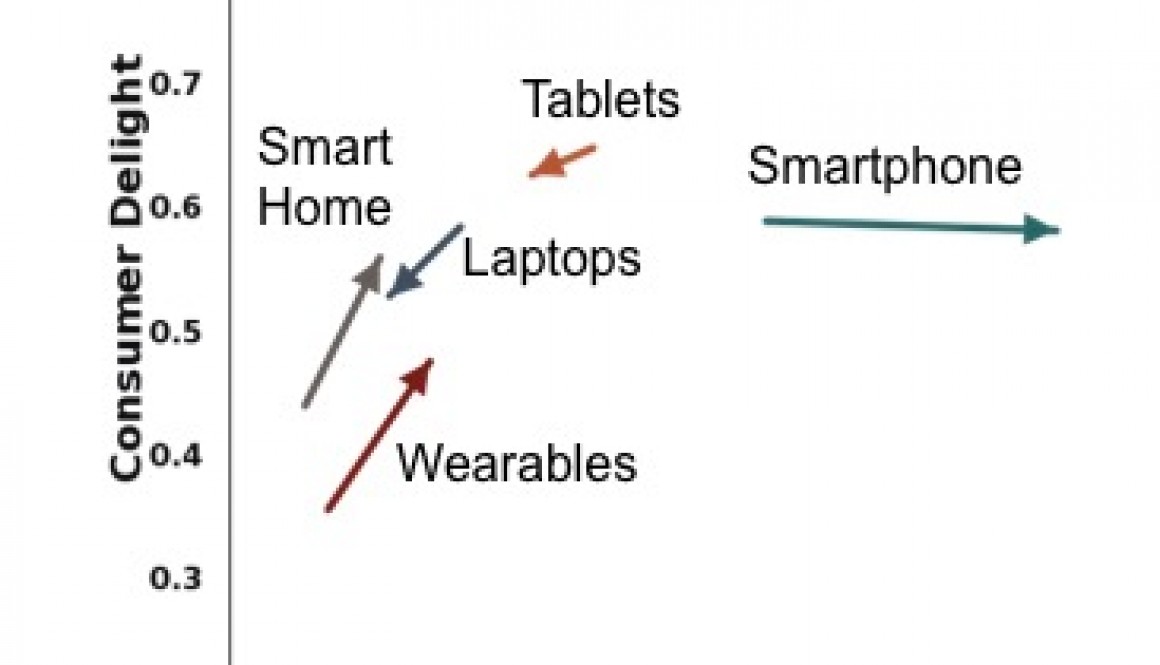

The final electoral map from the New York Times showing where key states flipped in directions options of what the polls were indicating. Much of the momentum behind the polling activity missed the actual votes completely.

Now in Nate’s defense, this wasn’t a zero chance of Trump’s win. 538 did suggest that Trump had a 28.6% chance of getting at least the necessary 270 electoral votes to clinch the presidency. But what the polls were telling us along with this analysis is that it was unlikely that Trump would win. As it turned out, the polls were not an accurate reflection of the population. Polls have become the buggy whips of Market Intelligence, useful during their time but if you’ve ever tried to whip your Prius to make it go faster, that’s equivalent to using a survey to instrument your market. While this has been spoken of in dark (and light) corners for years, this was a complete breakdown of our ability to instrument populations with any appreciable accuracy. And since many survey companies stake their ability to represent populations based on their success in predicting election outcomes, we have a problem.

We have spent decades trusting our politics, our products, our marketing, our movies, our futures to the results of surveys and polls. Companies and political action committees alike spend billions every year on constant surveys of their target populations of customers/voters. Tuesday’s outcome indicated what a colossal waste of time and money that is. That these methods no longer reflect, with any useful accuracy, what is actually happening in the market place. With all the talk of voter fraud, we should spend more time looking at the fraud perpetuated by polls and surveys. These methods lead to a blindness on the part of the organizations that commission them. Nokia was blinded by their own surveys to the threat of Apple and the iPhone. Axe Body Spray was blind to the misogyny their ad campaigns rained down on half the population when they tried to launch their first odor (scent) for women. And now we have evidence that polls contributed to the blindness the media and the Clinton campaign had to the real strength of Trump’s support.

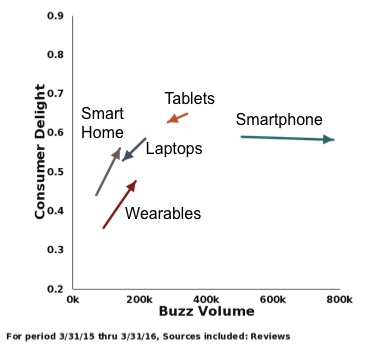

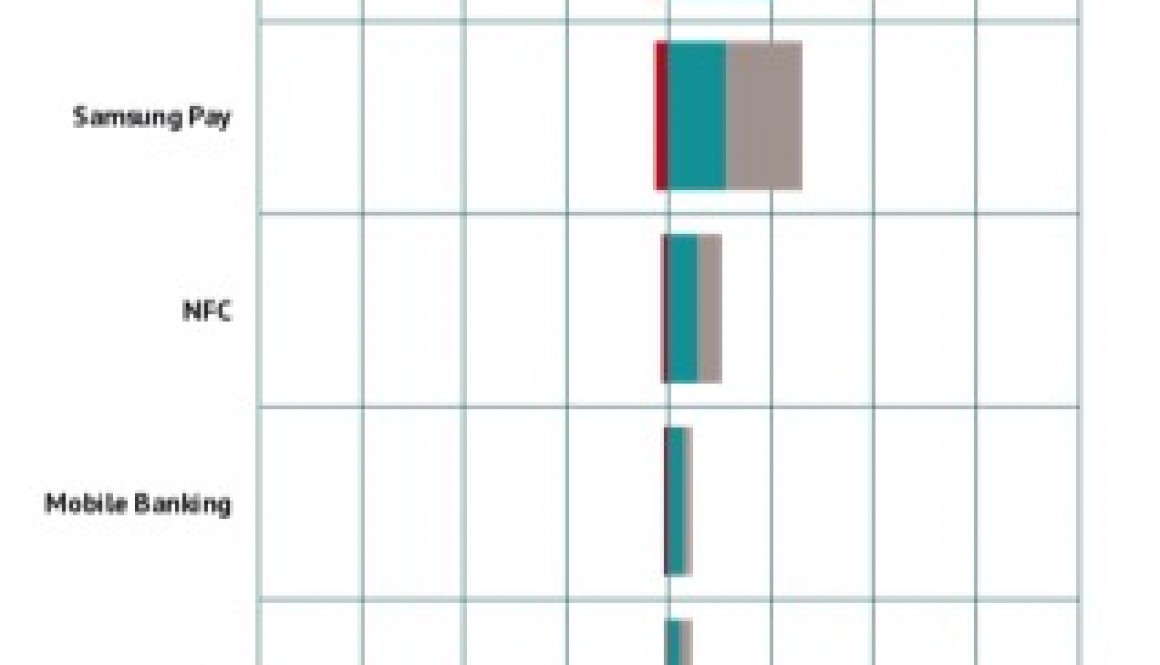

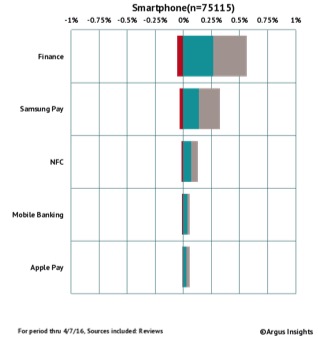

From the beginning Argus Insights has focused on building metrics based on “Should” rather than “Could.” Heavily influenced by my time at IDEO and Stanford’s d.school, we have always centered on observation over stimulation, listening over asking, because, like Heisenberg’s famous uncertainty principle (not meth recipe), the very act of taking a poll changes the validity of the answers given to a pollster. We do not prove our performance by showing our ability to predict elections, but showing how our metrics align with consumer acceptance. Companies need to open their eyes to their actual consumers, across the entire market, not just those willing to reflect your opinion foisted on them through constant surveys. Polls have proven to be a waste of resources, both time and money. Now we risk our future if we continue to rely on these inaccurate methods of instrumenting populations. Instrumenting the actions consumers take across the entire market is the key to avoiding brand blindness and it is something we have spent the last seven years perfecting here at Argus Insights. How else have we been able to beat Wall Street analyst estimates of iPhone sales almost every quarter for the last five years? We listen and observe, we don’t poke and frustrate. And as a result, we have a pretty accurate crystal ball.

If you want to join the post poll movement or just ask questions about how we whip up our secret sauce, let me know. Our goal from the beginning has been to put into the hands of decision makers the best evidence for driving innovation and growth. With our new Argus Analyzer toolset, we’ve made taking that first step even easier.