[wpsr_socialbts][wpsr_linkedin]

China and US Smartphone Consumer Demand Data for Full Q1 Shows Battle for Second in China, in US a Slip in Apple Demand

Argus Insights analysis of millions of social conversations and real consumer reviews shows Motorola recovers some luster and Blu leads rush in unlocked phones

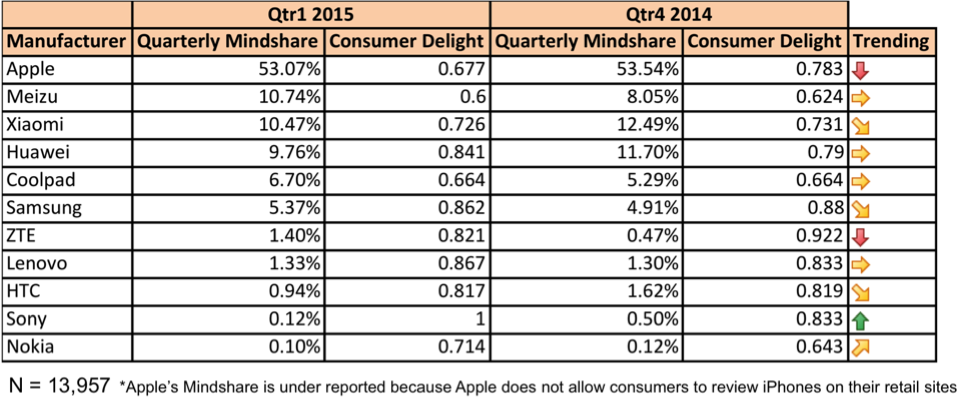

Los Gatos, CA, April 9, 2015 – Consumer mindshare for Apple iPhones continued to be high in China and the US over Q1 but with some interesting shifts from previous quarters as other brands fight for attention, according to the Smartphone Global Snapshot with Quarterly Trend Information for January through March, 2015 from market intelligence firm Argus Insights. In data released today, Argus Insights reveals that in March China’s Meizu stole mindshare from the previous number two Xiaomi and from Huawei to claw its way to the second spot. Argus Insights mindshare metrics are proven leading indicators of consumer demand.

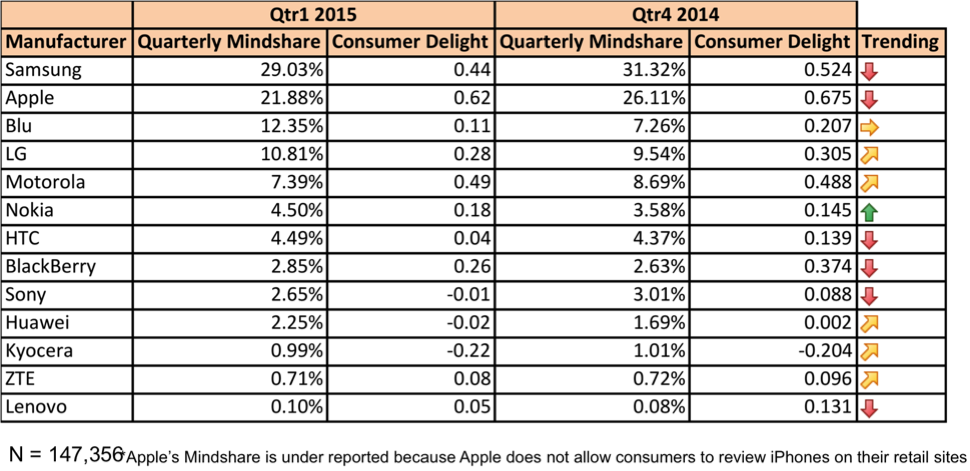

In the US, Apple smartphones continued to delight American consumers however the data show that the global leader is being increasingly threatened by Motorola and Nokia as smartphone demand slows and fragments. Motorola, in fact, is now at number two behind Apple in terms of overall consumer delight.

“This has been a powerful quarter for Apple in China as we all have known, but the most interesting news came in the last month where we have seen that dip by Xiaomi which had been holding tight to the number two slot for months,” said John Feland, CEO, Argus Insights. “We’ve seen Meizu climb in mindshare from 8.05% in Q4 2014 to 10.74% last quarter. That increase came at the expense of Xiaomi which dropped 2 points – from 12.49% to 10.47% between the two quarters and from Huawei which also dropped 2 points – from 11.7% to 9.76%.”

Q1 saw United States consumer demand for most smartphone brands fall with two notable exceptions, Blu and Nokia. Blu, a growing purveyor of unlocked handsets sold through Amazon and Walmart, continues to piggyback on T-Mobile’s uncarrier positioning as US consumers seek good enough handsets that can be used across multiple carriers, both prepaid and postpaid. Nokia was the only brand to show increased demand and happier customers.

“Recent Nokia handsets are getting increased traction in the US thanks to increased demand at both T-Mobile and Boost,” said Feland. “The experience gap between Windows and the other handset operating systems has narrowed enough to appeal to consumers looking for something different from the dominant iOS or Android handsets. This supports a growing trend where consumers looking for a differentiated experience drive a fragmentation of the US smartphone market. This has impacted Samsung especially hard as upstarts like Blu and OnePlus sneak market share away.”

For more information and to download the Argus Insights 2015 Q1 Smartphone Consumer Demand Snapshot click here

About Argus Insights & Methodology

Argus Insights is a new type of market intelligence company founded by tech industry veterans seeking to connect the dots between technology innovation and consumer adoption. Argus Insights provides focused and actionable analysis on where consumers are taking the market, who is winning and why. Argus Insights is continuously monitoring millions of consumer reviews and comprehensive social conversations to derive feedback straight from the source. Our proprietary metrics of consumer mindshare and delight allow us to identify what attributes are important to the end user, rank product and brand performance, and accurately forecast adoption.

Argus Insights creates monthly mindshare analysis reports for paid subscribers within days of the month’s end so clients can act quickly, rather than wait for traditional reports which lag more than a month behind.

For more information, visit https://argusinsights.com/

Media Contact:

Erica Zeidenberg

erica@hottomato.net

Hot Tomato Marketing

925-631-0553