Smart Home Service Providers Slide After Tremendous Holiday Season: Q1 2017 Results

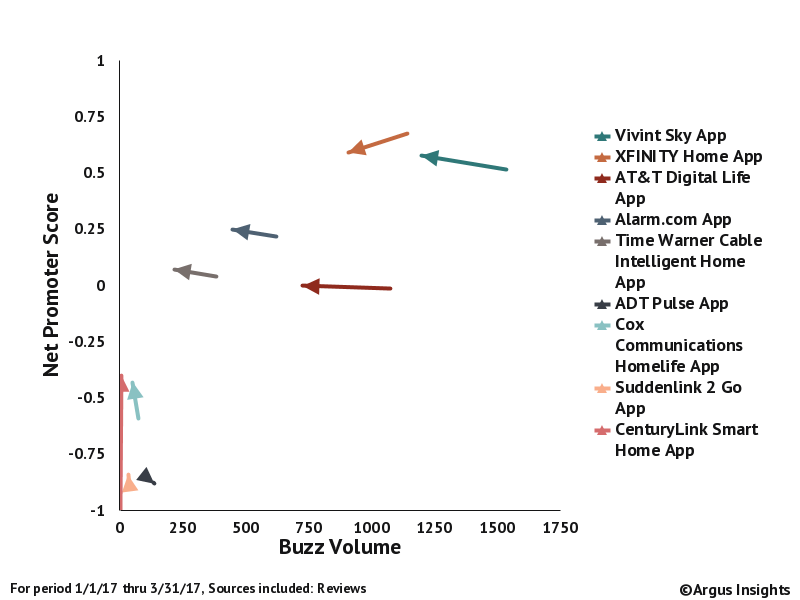

While much of the Smart Home market is focused on Do It Yourself, there has also been robust demand within the Do It For Me part of the market supported by Smart Home Service providers like Vivint or Comcast Xfinity Home. While overall consumer interest declined in Q1 2017 over Q4 2016, March 2017 saw a significant increase over February 2017, indicating that a combination of spring promotions and increased interest in Do It For Me based on holiday DIY experiments.

Vivint clearly wins out for the overall consumer demand during Q1. Most service provider customers write reviews soon after they sign up or after a new version of the App has been released. We can see from the graph above that Vivint leads the overall tally of quarterly mindshare but lags a bit behind Comcast with respect to Net Promoter Score. AT&T is still in the mix but has more frustrated consumers than Comcast or Vivint. In March, Vivint saw improvements in their UX while Comcast dropped over the quarter so they they are within 1% of NPS from each other.

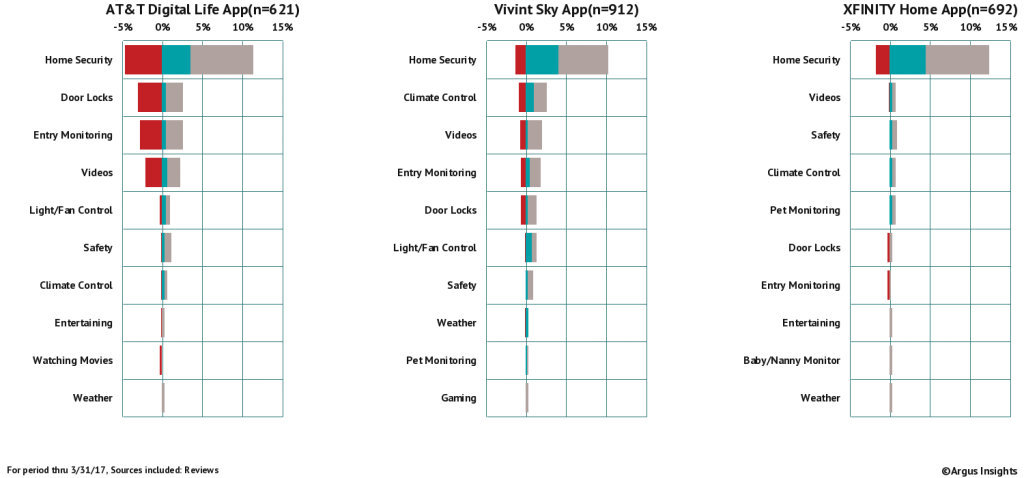

When we dig deeper into how consumers report using their Smart Home with their lives, it should come as no surprise that Home Security is the most discussed usage scenario. Securing your home is still the main reason consumers sign up for Do It For Me services though you can see this shifting for Vivint as they list Climate Control more than any other service provider. AT&T customers are clearly grump about their security and entry control experience with Digital Life. Comcast customers are focused on Security almost to the exclusion of other scenarios though Xfinity customers mention monitoring their pets more than AT&T or Vivint customers.

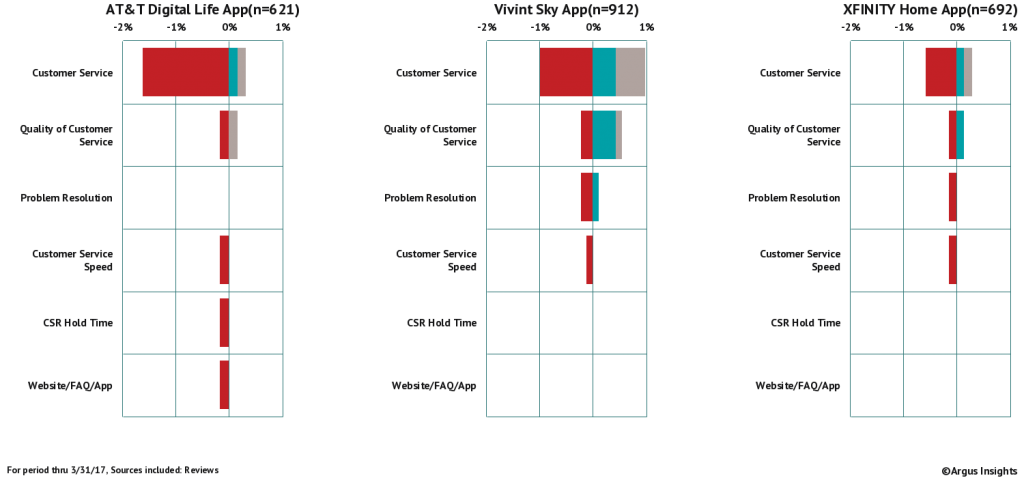

Customers of Do It For Me tend to value Customer Service in their selection of service providers. While consumers do not mention their experience with Customer Service as much as other topics, you can see a definite correlation between the service provider’s Net Promoter Score and the consumer perception of their customer service experience. AT&T has the most negative mentions of the top three service providers. Vivint has more negative comments than Xfinity but also more positive. Vivint is also the only provider with a net positive perception of the Quality of Customer Service, a surprising outcome to be sure.

Of course we have more data behind just this basic analysis. Quotes from consumers on specific issues, comments on the installation process and more, with data going back literally years to assess the impact of changes and new innovations being unleashed on the Smart Home market. You can get access to these tools yourself, using the Argus Analyzer. Learn more by clicking below.

Sales Match Delight as Xiaomi & Huawei Threaten Samsung & Apple

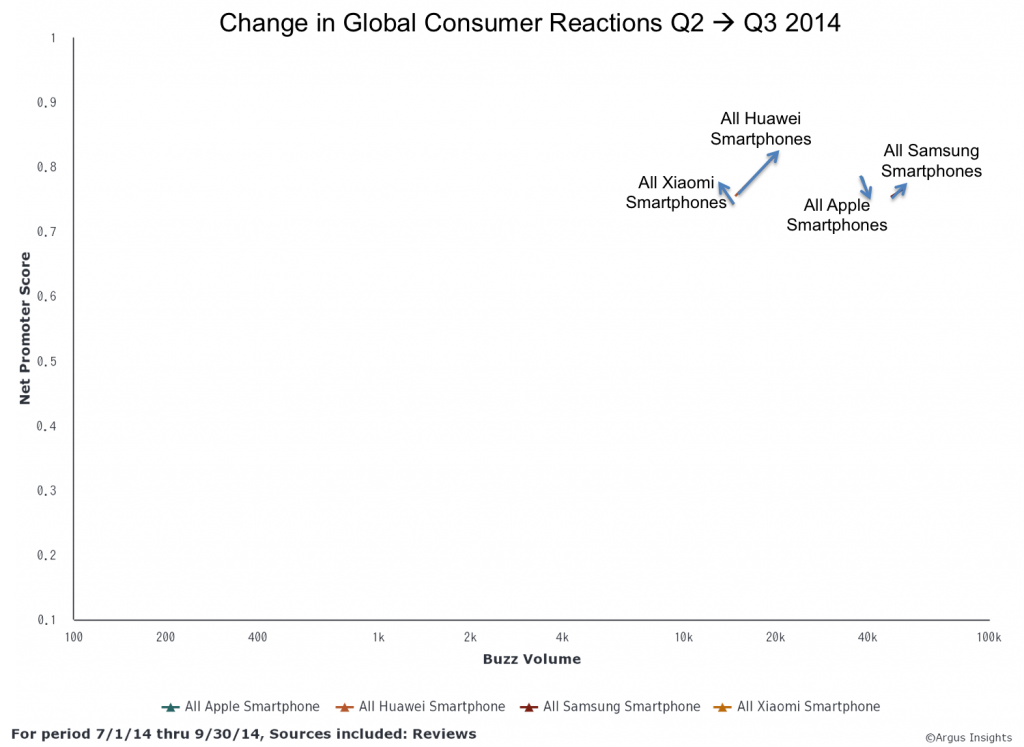

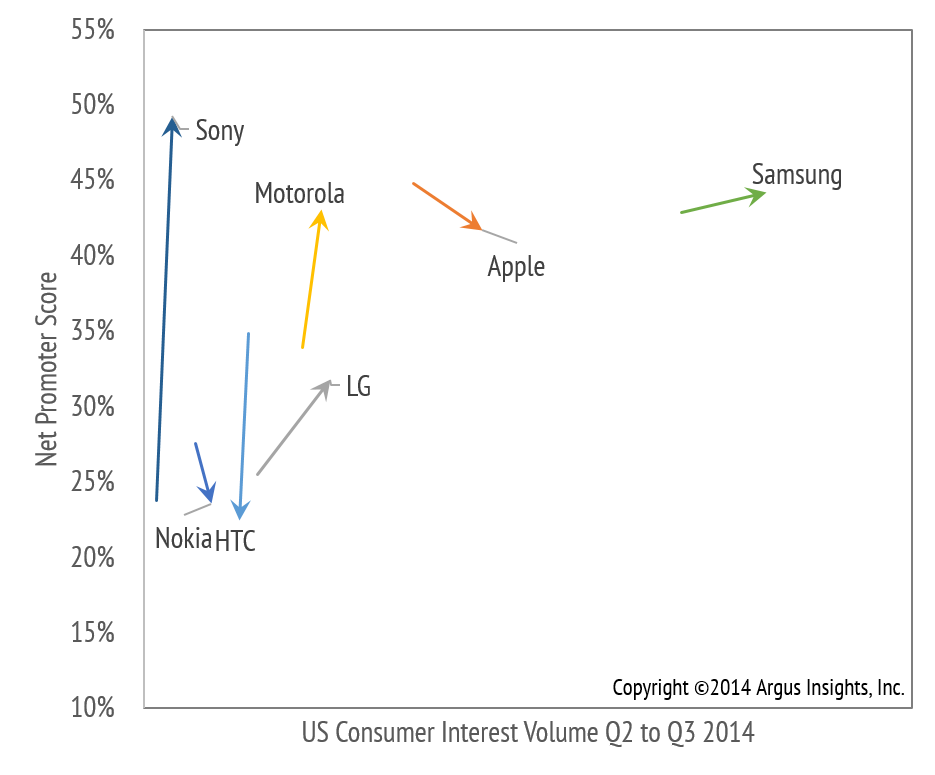

On December 5th, Argus Insights published a blog detailing the Rise of the Chinese Smartphone Manufacturers, which examined the improvement in Huawei, Lenovo, and Xiaomi’s consumer buzz and delight, compared to Samsung’s falling approval, from May to November of 2014. On December 15th, Gartner published their Q3 numbers, declaring that “Samsung Lost Market Share While Top Three Chinese Manufacturers Combined Smartphone Market Share Grew by Four Percentage Points”[1]. Examining the change in consumer reaction from Q2 to Q3 shows that consumers are finding delight in the smartphones they are increasingly purchasing from Huawei and Xiaomi, a promising trend that will likely lead to increased adoption.

Xiaomi saw an increase in delight, but a decrease in buzz volume, which can be partly attributed to the fact that China Unicom is the only Chinese carrier included in this data set. Nonetheless, the consumers that are reviewing Xiaomi smartphones are delighted. Huawei saw an even more dramatic increase in delight, driven largely by Amazon and China Unicom customers, which we detail in our November Consumer Demand Report. Apple and Samsung remain ahead in terms of review volume, but both these popular brands saw lower Net Promoter Scores than the rising Chinese manufacturers.

Consumers are turning to lower priced smartphones as brand becomes less important. This trend is catapulting other manufacturers into a market long dominated by Apple and Samsung. Argus Insights will continue to track changes in consumer preference but if you are interested in custom reports, access to our tools and data, or personal consultation, please contact us. For weekly updates on the Smartphone, Wearable, and Home Automation markets sign up for free newsletter.

[1] http://www.gartner.com/newsroom/id/2944819

OnePlus One or OneMinus One?

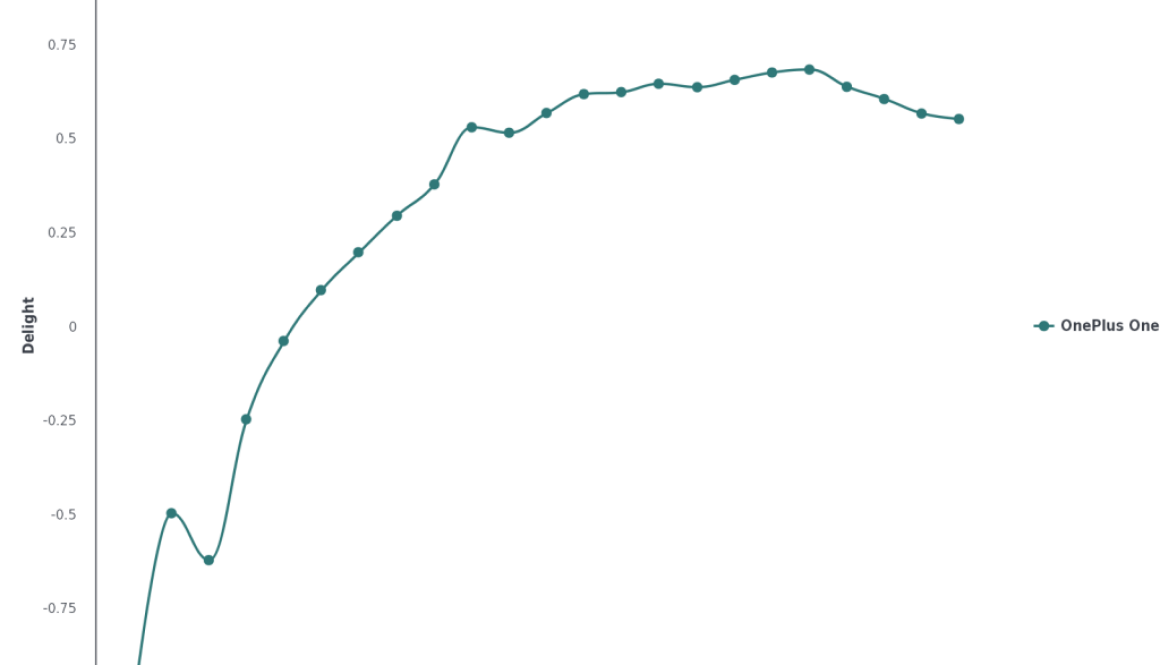

In November we covered the new kids on the block in the smartphone market, Chinese manufacturer OnePlus. Their goal was to disrupt the market by selling high-end smartphones for more than half the price of Apple, Samsung, HTC, etc. They succeeded in driving awareness to their campaign and gained approval from the consumers who took notice of their budget friendly smartphone, which boasts the same high-end features that are sought after in the iPhones and Samsung Galaxy phones.

OnePlus got off to a fast start as consumer demand quickly overwhelmed the limited supply of smartphones available. Due to the fact that the company is microscopic compared to the juggernauts in the industry, careful planning and strategic production were essential in growing the company and lowering the risk of bankruptcy. OnePlus came up with an invite system for consumers that were interested in purchasing the One, which allowed them to only produce what they can sell to prevent excess inventory. Lucky adopters that got their hands on an invite purchased the phone and delight numbers grew rapidly.

The combination of hungry buyers waiting for OnePlus to refill their buffet stations, and scalpers taking advantage of eager buyers, led to a drop in delight for the company towards the end of October as consumers began to voice the unpleasant experience in OnePlus’s supply chain and useless Chinese variants that are now nothing but expensive paperweights. It is also vital to point out that the drop in delight mostly reflects unhappiness due to limited supply, high prices on Amazon, and consumers that were duped into buying the Chinese variant of the OnePlus One. Overall, those fortunate enough to get their hands on the unicorn phone are still delighted in the One as a viable alternative to the more expensive smartphones on the market.

Argus Insights will continue to keep a close eye on OnePlus and the rest of the smartphone market as the year comes to an end and manufacturers push to move more inventory from retailers into the hands of consumers. To learn more, sign up for our free weekly updates about consumer smartphone perceptions.

[themify_button style=”small orange rect” link=”https://wx168.infusionsoft.com/app/page/2f2cce5475b4d89ed81040715d426feb” target=”_blank” ]Free Weekly Newsletter[/themify_button]

Visit our website to learn more about how Argus Insights can help you understand your consumers. Please contact us for custom analysis, personal consultation, or access to our data.

AT&T Misses Estimates, Cuts Forecast, Adds More Fuel to Fire Phone

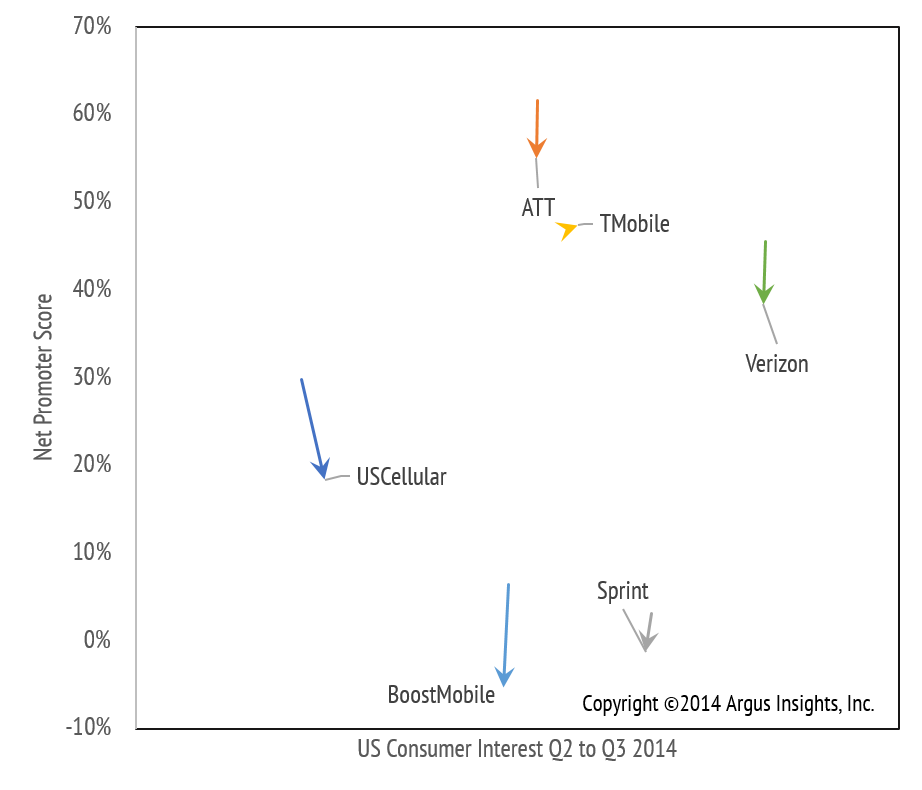

Scott Moritz’s coverage of AT&T’s recent miss of Wall Street expectations is just another bit of evidence that launching a new handset on AT&T’s network has not worked out well for AT&T or the handset manufacturer. The graph below demonstrates that AT&T is not alone in this descent, as every Smartphone retailer except T Mobile saw a drop in consumer delight from Q2 to Q3. As retailers are fighting to maintain subscribers, it appears they are sacrificing service as their new and current consumers are reportedly less satisfied.

After Amazon’s Fire Phone underperformed earlier this year with AT&T as its exclusive retailer, the bad news keeps coming. While AT&T is still the most loved retailer on this chart, they saw a drastic drop in NPS. AT&T saw a growth of “785,000 monthly subscribers,” but they are losing revenue as “7 percent of customers…brought their own devices instead of buying one.” This, along with other factors, reportedly drove the average AT&T customer bill (excluding installment payments) down 8%. The Quarter brought less money for AT&T, less new handset sales for manufactures, and less delight for consumers.

Consumer delight is dropping across retailers in the Smartphone market as retailers are participating in a “pricing battle” to “protect their subscriber base.” Argus Insights will continue to track this battle in the smartphone market and keep you updated. For more information about any retailer, brand, or product across any of the sectors we cover, please contact Argus Insights. If you interested in free weekly insights about Smartphones, Wearables, or Home Automation, sign up for our Weekly Newsletter.

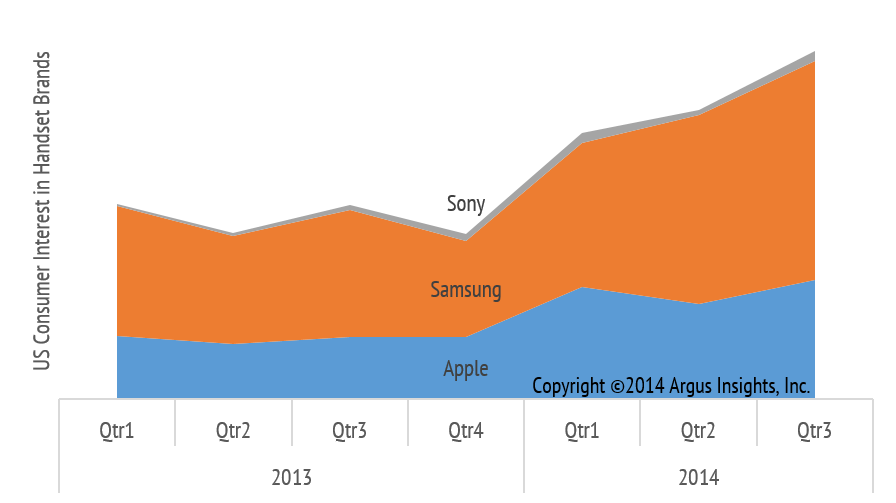

Rumors of Sony’s Death Knell in Smartphones are Widely Exaggerated

Takashi Mochizuki recently published an article that Sony has once again cut their sales targets for mobile devices, which was a prudent move for Sony given the global competition they face. But hold in there, they aren’t dead yet. Our analysis shows that Sony has actually gained Mindshare in Q3 2014, just not at a rate to move the needle on quarterly expectations. Sony still lags behind all other handset brands in terms of buzz volume, but saw a spike in Net Promoter Score. This means that while their products are not widely discussed, the few consumers reviewing them are delighted. Motorola experienced a similar resurgence thanks to the Moto G and Moto X. The increasing delight surrounding Sony and Motorola show that consumers do not need the prestige that comes with an iPhone of Galaxy smartphone; in fact, they are enjoying less popular handsets more.

While Sony is clearly not as popular as Apple and Samsung, they are seeing a different type of growth. People cannot stop talking about iPhones and Galaxy phones in general, but consumers cannot stop saying good things about Sony smartphones. It is one thing to be popular, but a few delighted allies can go a long way.

We will continue to track Sony’s progress along with consumer perceptions of Motorola, Apple, Samsung, and others. Please contact Argus Insights if you would like more specific information regarding any smartphone brands or products, or information about any other sectors we cover. If you want more information about the market as a whole, you can order our Monthly Smartphone Report or sign up for our free Weekly Newsletter. Let us tell you how to make consumers happy to make your business even happier.